INTRODUCTION AND BRIEF DESCRIPTION

This section defines theft as the fraudulent failure to account for or pay back something received under terms or conditions requiring accountability.

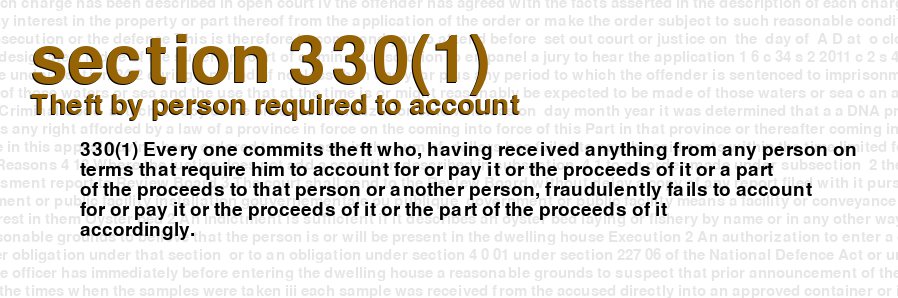

SECTION WORDING

330(1) Every one commits theft who, having received anything from any person on terms that require him to account for or pay it or the proceeds of it or a part of the proceeds to that person or another person, fraudulently fails to account for or pay it or the proceeds of it or the part of the proceeds of it accordingly.

EXPLANATION

Section 330(1) of the Criminal Code of Canada is a provision that criminalizes theft by fraud or failure to account for proceeds. Specifically, it applies to situations where a person receives something from another person on terms that require them to account for or pay it or its proceeds to either the original person or another person, and the recipient fraudulently fails to do so. This provision is designed to protect individuals who entrust their property or money to others on the condition that they will account for it or use it in a certain way. By making it a criminal offence to fraudulently fail to account for or pay such property or money, the law seeks to deter individuals from acting dishonestly in these situations. For example, imagine that an employee is entrusted with company funds to attend a business conference, on the condition that they provide receipts and return any unused money. If the employee instead pockets the excess cash and fails to provide receipts, they could be charged with theft under this provision. The offence under Section 330(1) is considered a form of theft, which is a serious criminal offence under Canadian law. If convicted, the offender could face imprisonment of up to two years if the amount in question is less than $5,000, or up to 10 years if it is more than $5,000. They may also be required to pay restitution and face other legal consequences. Overall, Section 330(1) of the Criminal Code of Canada is an important provision that helps to protect individuals from fraudulent behaviour. By holding individuals accountable for their actions and imposing serious consequences for such conduct, the law seeks to promote honesty and fairness in transactions between individuals and organizations.

COMMENTARY

Section 330(1) of the Criminal Code of Canada establishes the charge of theft by failing to account for or pay for money or property that have been received on terms or conditions that require such accountability. This section of the Criminal Code aims to protect individuals who entrust their property or money to someone on the basis of a relationship that entails some form of trust. This provision applies when an individual, who has received cash or property on terms that require him/her to account for or pay it back, fails to do so fraudulently. The element of fraud is a crucial aspect of this section of the Criminal Code. For charges under section 330(1) to proceed, prosecutors must demonstrate that the accused had the intention to deceive or defraud; in other words, to intentionally mislead the person who entrusted the accused with the money or property. Theft by failing to account for or pay for is a lesser-known form of theft that occurs more often in business settings where there deals are made based on trust and relationships. For example, it can occur when an employee who collects sales proceeds on behalf of an employer but doesn't turn in the money. It is also applicable in loan agreements or where a person has entrusted their property to someone for safekeeping. It is important to note that for a conviction on this charge to occur, there needs to be an agreement, either express or implied, between the parties involved. That agreement requires the holder of the property to pay back the owner or be accountable for it. This arrangement can be through a contract, in writing or verbal agreement. When the parties are clear on the intentions of each other, it makes bringing a successful charge under section 330(1) of the Criminal Code of Canada easier. The pain of being a victim under this law can be immense. Victims of this charge can suffer not only monetary losses but also a breach of trust by the person who was entrusted with their funds. The provisions of this section of the Criminal Code provide protection for these individuals, and they can seek remedies and justice by bringing the offender(s) to account. In conclusion, section 330(1) the Criminal Code of Canada, represents a crucial safeguard that seeks to protect individuals' property or money through trust-based relationships. It applies in cases where a person has fraudulently failed to pay for or account for money received on terms that include accountability agreements. The element of fraud is central to this provision, which means that prosecutors must demonstrate the accused's intention to deceive or defraud during the trial. Victims of this charge can experience not only financial loss but also an erosion of trust. The intent of this section is to deter theft through accountability mechanisms and allow victims of this theft to seek justice in a court of law.

STRATEGY

Section 330(1) of the Criminal Code of Canada establishes theft by failing to account or pay it fraudulently when someone receives anything on terms that require them to account for or pay it back. This section is essential to maintaining integrity and preventing fraud in various business and financial settings, such as lending, investments, and contracts. However, dealing with this section requires specific strategic considerations to ensure effective enforcement and minimize losses or damage to all parties involved. First and foremost, one of the most significant strategic considerations is to determine whether the individual accused of theft had the intention to defraud or whether they simply made an honest mistake. Without establishing fraudulent or intentional conduct, Section 330(1) cannot apply. Therefore, it is crucial to have evidence that supports the presence of fraudulent intent, such as proof of concealment, misrepresentation, or dishonest behaviour. Another strategic consideration is to determine whether the accused had the authority to use the fund in question. In some cases, business transactions may have approved limits, and someone using the funds within these limits may not constitute theft under this section. Therefore, it is essential to understand the specific conditions and terms under which the transaction occurred to determine whether the accused had the legal power to dispose of the funds or whether they acted beyond the scope of their authority. Furthermore, when dealing with Section 330(1), it is essential to consider the various parties involved, including the victim, the accused individual, and any other relevant parties. This will help determine which strategies could be most effective in criminal or civil litigation, negotiation, or alternative dispute resolution. For instance, negotiating a repayment plan instead of pursuing costly litigation could be a viable option if the accused admits wrongdoing and shows a willingness to make things right. Another strategic approach for victims would be to have a clear contract in place that outlines the conditions under which the funds were loaned or entrusted to someone. This could both serve to prevent theft and establish a more straightforward case if the situation becomes litigious. Additionally, businesses, individuals, and organizations should focus on creating robust internal controls and policies that help detect suspicious activity and prevent fraudulent behaviour in the first place. In conclusion, dealing with Section 330(1) of the Criminal Code of Canada requires a strategic approach that takes into account several factors. The nature of the transaction, the presence of fraudulent or intentional conduct, the authority of the individual accused, and the various parties involved are all critical considerations. Additionally, having clear contracts, internal controls, and policies can help prevent theft and establish a more straightforward case if the situation becomes litigious. By employing these strategies, organizations and individuals can minimize the risk of fraud, ensure accountability, and protect their interests.